High earner

The more successful you’ve been, the more important it is to protect what you have, and a financial plan can make that process far easier.

FOCUS

FINDING FOCUS

In theory, having a larger income should mean fewer money worries. In practice, you simply face different issues that make financial planning crucial.

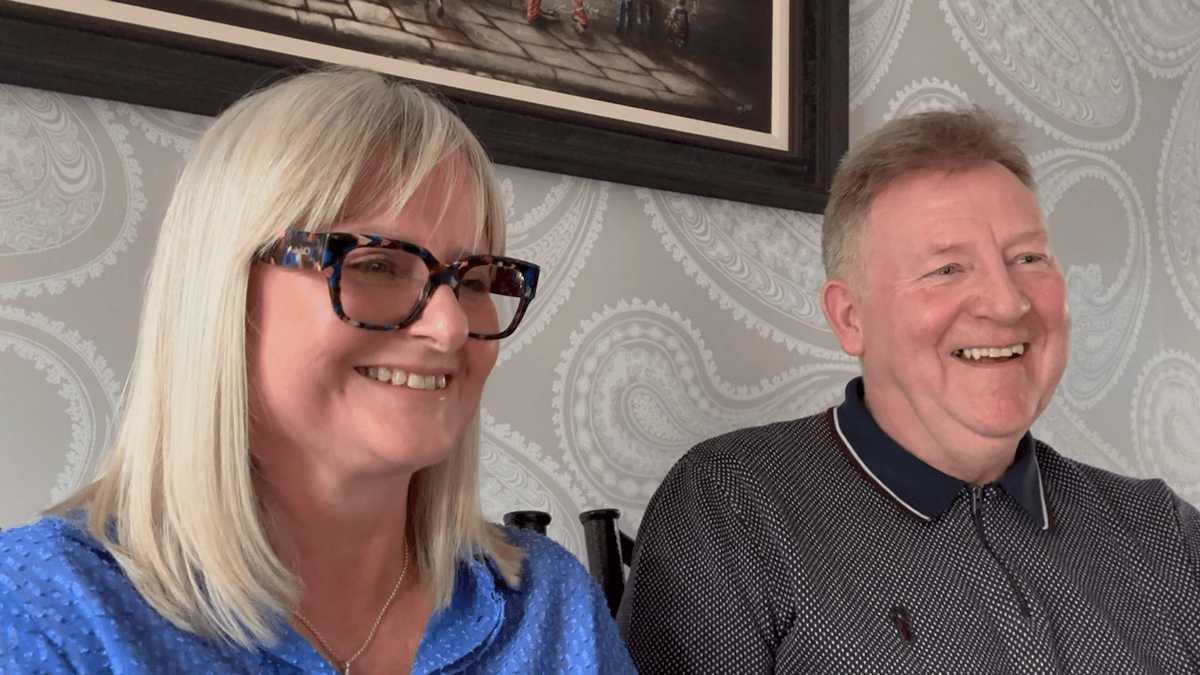

As my client, you’ll benefit from my long experience managing portfolios for high net worth individuals. I’ll help you prioritise the right things, both financial and personal, for a better quality of life.

I do

what I do

Financial planning gives you an in-depth visual representation of your circumstances and how they could change, thanks to sophisticated cashflow modelling software. This allows us to work out your “number”, or what amount is enough to achieve all your goals. You might have already reached that point, but if not, I’ll devise a strategy to get you there.

Once we’ve built your financial plan and worked out how much you need for your dream retirement, we can make sure your pension arrangements align with it. If they don’t provide the right levels of growth or flexibility, it’s time for a change. I’ll explore the whole of the available market to find the providers or products that are a better fit for you.

Without the right type or degree of insurance in place, your assets are at risk, but your financial plan will reveal the gaps to plug. For high earners, solutions such as life insurance and income protection are usually essential. But I’ll look at the whole picture when making my recommendations, so you can feel confident they’re tailored to your needs.

Tax is a complicated area, so it’s unsurprising that many high earners don’t fully understand or make the most of the allowances that are available to them. With a few small tweaks, you may be able to make big savings and keep hold of more of the money you’ve worked so hard to earn. I’ll review your current status and improve on it however possible.

What I don’t do

Anything on your behalf that you haven’t expressly agreed to.

Treat our partnership like a one-off, short-term transaction.

Final salary pensions transfers. I can refer you to a trusted third party instead.

works

How it works

Financial planning should be a partnership, not a transaction. With Polaris Wealth Management, you’ll follow a simple six-step process that offers expert support at every stage.

Show me moreFind me on VouchedFor

I’m thrilled to have been awarded Top Rated status every year since 2016 by VouchedFor, the UK’s leading independent review site for financial planners. Click or tap on the badge to read my reviews.

advice?

NEED MORTGAGE ADVICE?

Property is likely to be your biggest investment, so it’s important to get the best deal you can. Whether you’re buying somewhere new or looking to remortgage, I’ll make the process as stress-free as possible.

tell me more