How it

works

With Polaris Wealth Management, you’ll follow a simple six-step process that offers expert support at every stage.

JOURNEY

YOUR JOURNEY

Some financial challenges are more difficult than others, but that doesn’t mean the route you take to solve them needs to be complicated. Whatever you want help with, my tried-and-tested approach will make the process feel effortless.

Together, we’ll create a financial plan to help you achieve your desired outcome and then I’ll carry it out on your behalf. See the steps in more detail below.

1. Introductory call

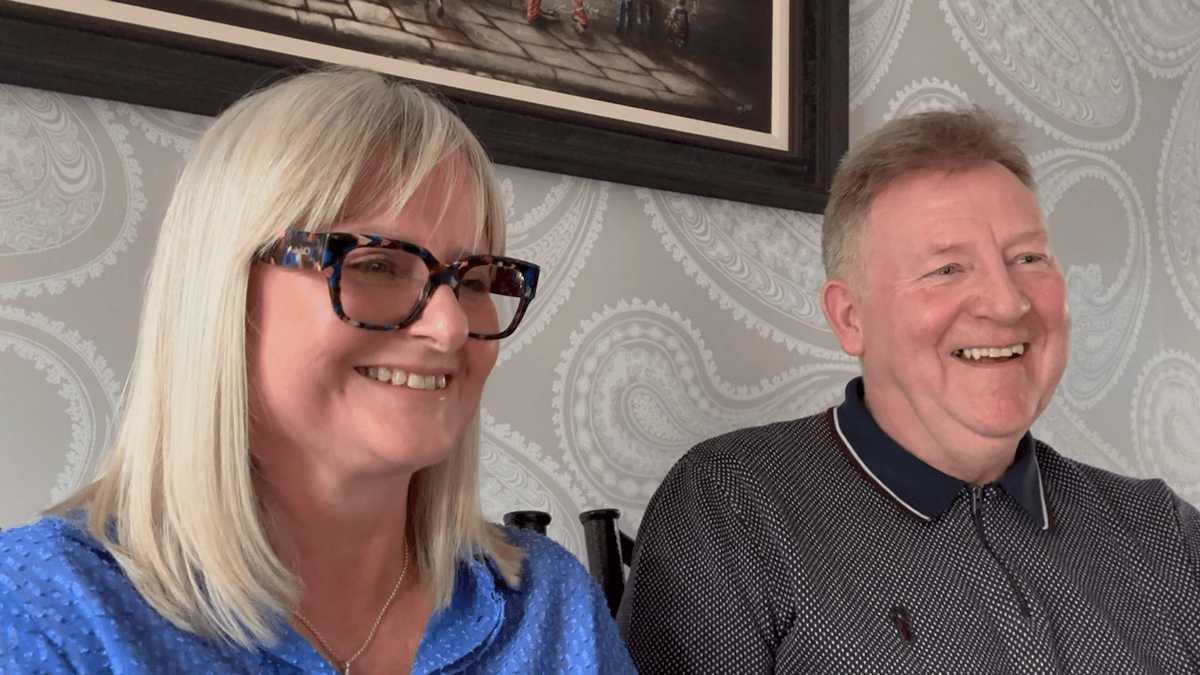

The purpose of the introductory call is all about seeing if we’re the right fit for each other. We’ll talk about your aims and personal circumstances to understand how we can help. You can use this call to ask me any questions you may have.

This introductory meeting is held via Zoom or Teams or on the telephone. The meeting is completely free, and there’s no obligation to proceed if you don’t want to.

2. Discovery meeting

We take the time to understand you, your values, goals and objectives, along with any existing policies or arrangements you already have in place. This fact-finding stage provides a solid bedrock from which to build a comprehensive financial plan.

For this meeting, I will visit you at your home or your place of work, or we can meet via Zoom or Teams – whatever works best for you.

3. Investment discussion

There are a variety of ways to grow your wealth and reach your goals, but first, we need to understand your attitude towards investing. In this follow-up meeting, we’ll talk about the different types of assets you can invest in and how you feel about risk. We’ll also show you and explain our investment philosophy.

Whether you’re an experienced investor or just starting out, everything will be explained in clear, easy-to-follow terms.

4. Planning Meeting

With a draft plan in place, we will meet to finalise your financial roadmap together. You’ll see a demonstration of the impact of your financial decisions along with our recommendations, using cashflow analysis to model different scenarios. Only once you are entirely happy will we agree on your financial plan.

5. Implementation

Once you’re happy with your financial plan, it is time to put it into practice. We’ll contact product providers on your behalf and deal with all administrative tasks, so you have nothing to worry about.

Following implementation, we will be in touch (typically after six weeks) to help you organise the agreed actions.

6. Ongoing review

Your plan is designed for long-term success, not quick wins. We will communicate with you regularly and review your plan each year to ensure you remain on track to meet your lifestyle goals.

Our annual reviews are a chance for us to update you on your investments and the progress we’ve made towards your end goals. It’s also a chance for us to revisit your attitude to risk and find out if there are any new options we could be taking advantage of to grow or protect your wealth.

Financial planning explained

You won’t get very far in your financial journey without a proper plan in place. Learn all about the advantages of this approach.

see more

FAQs

Get answers to the most common questions about Polaris Wealth Management, the process of working with a financial planner, and more.

show FAQs

Fees

No hidden charges. No smoke and mirrors. See in full the fees that you’ll pay and learn precisely what services you’ll get in return.

view Fees

advice?

Need mortgage advice?

Property is likely to be your biggest investment, so it’s important to get the best deal you can. Whether you’re buying somewhere new or looking to remortgage, I’ll make the process as stress-free as possible.

tell me more